Sourcing Watches in China Tips

Sourcing Watches in China is a Challenging work, with a population of 1.421 billion, China has an endless number of Watches suppliers, So before sourcing wataches in China, You should know:

- The Watch Market share and China’s role, Why?

- Where’s the Watches supplier in China?

- What Methods and Types of Watches?

- Sourcing method( local b2b platform and trade fairs)

- Contacing method( wechat and whatsapp)

- Some attentions & avoidable things when soucing from China( Quality, logistics , Scams, Trademarks)

this is a general guide for online brands and new starters, Let’s discover more,

Why Sourcing Watches in China?

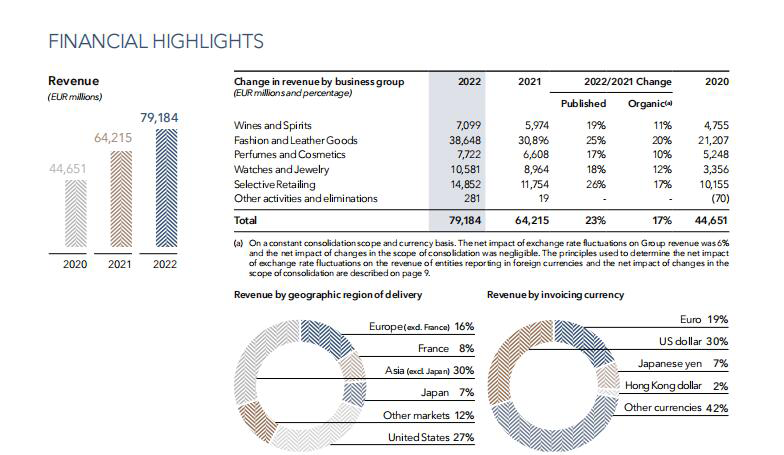

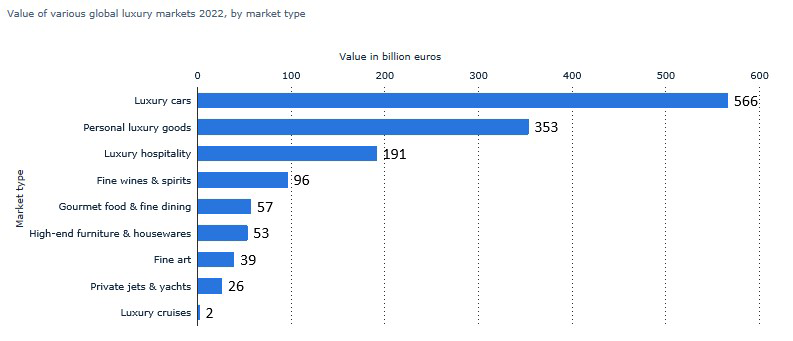

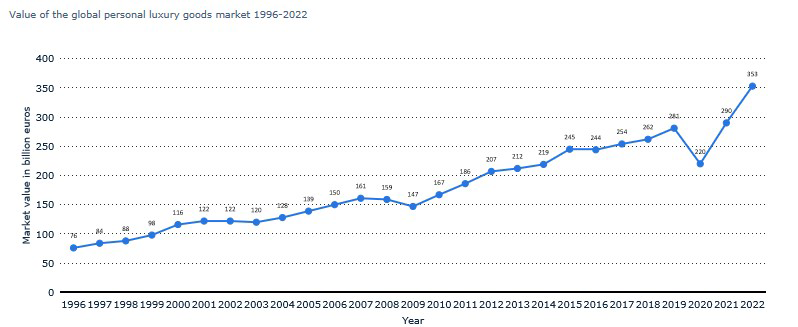

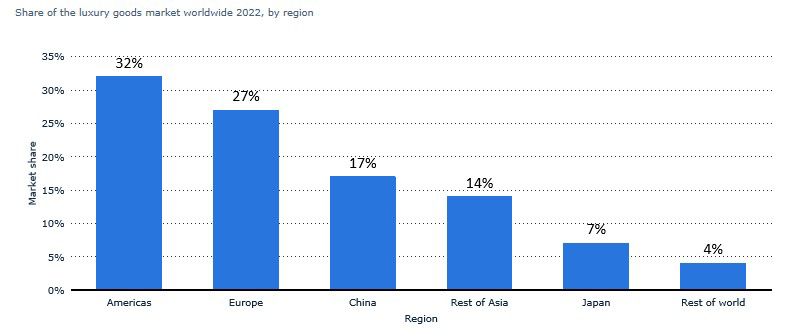

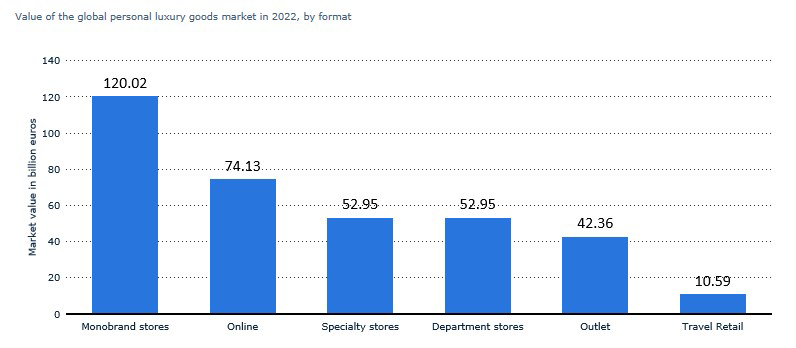

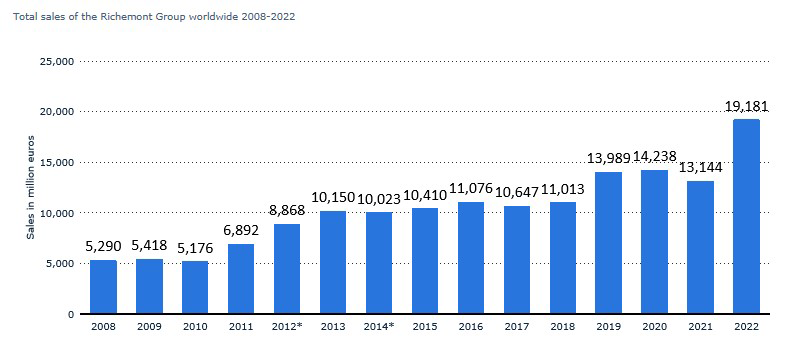

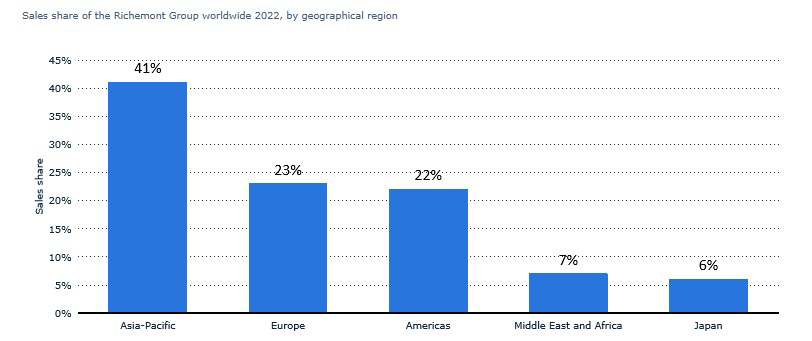

Speaking of why sourcing watches in China, Let’s see the watch market and China’s roles in international market

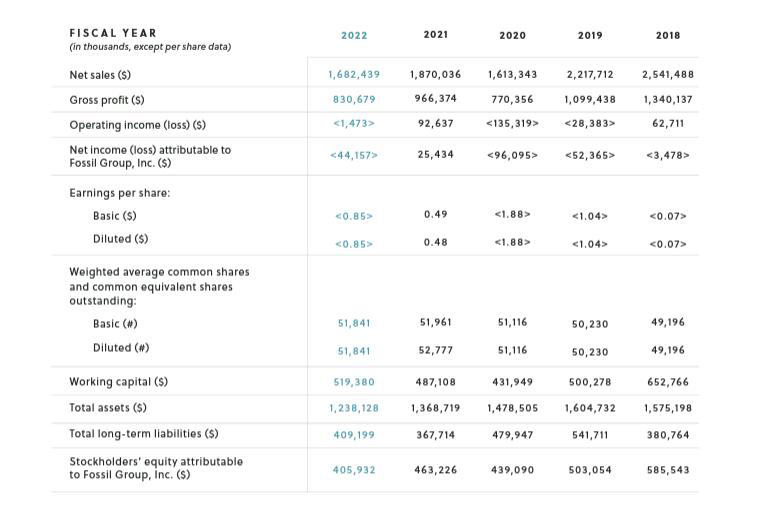

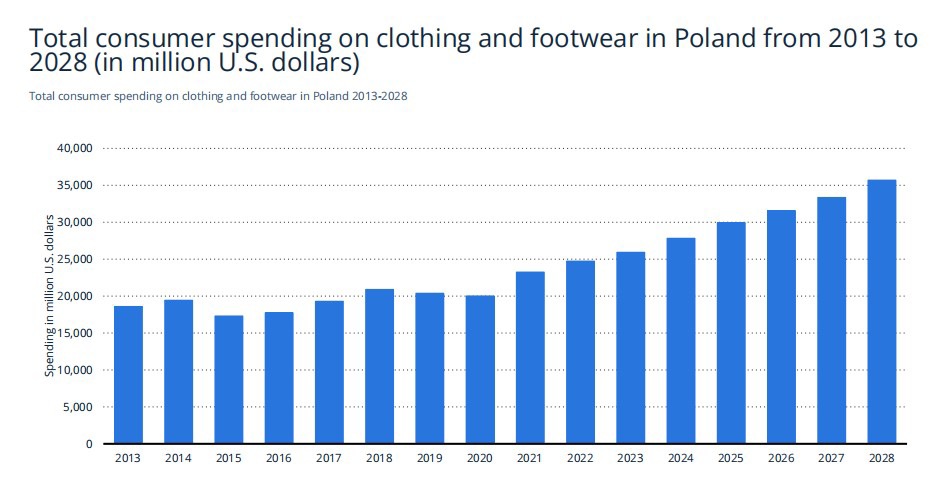

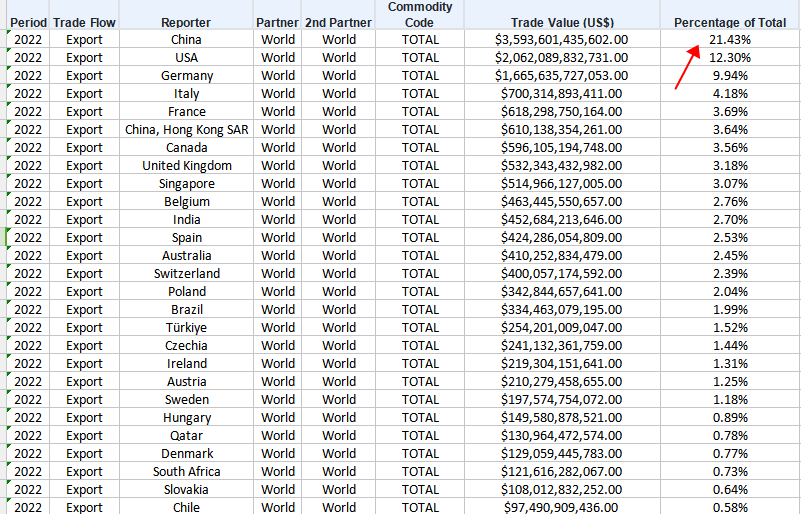

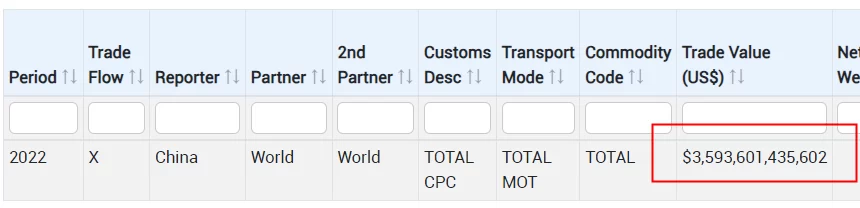

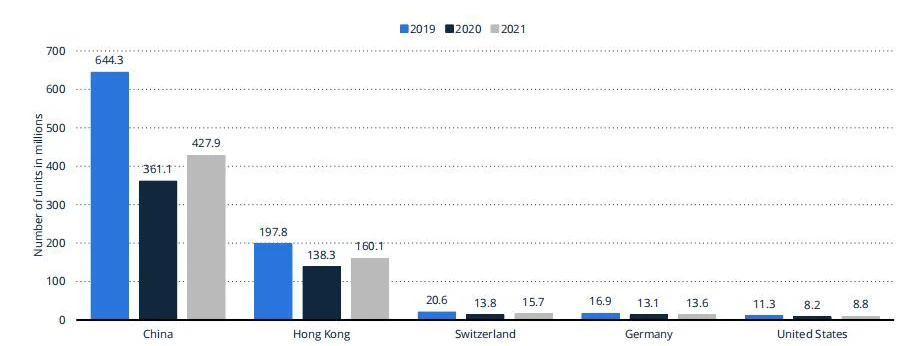

Reason 1: China’s Export Percentage

In Year 2022, China occupied 21.43% of the total world’s export amount, the next is USA, Germany, Italy and France

Data from UN datacomtrade

Reason 2: The Rank of China’s Import Value

China had become a big name in the worldwide watch market.

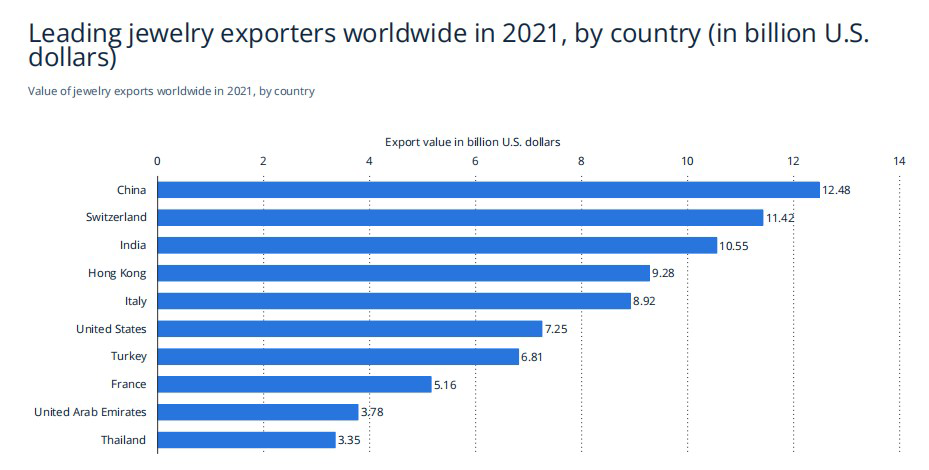

from exporting countries, you can see, leading countries worldwide in year 2019- 2022 is ranked :

- #1: China

- #2:Hongkong(Hong Kong often reports higher export figures because many Chinese sellers ship packages through Hong Kong to bypass higher taxe).

- #3: Switzerland

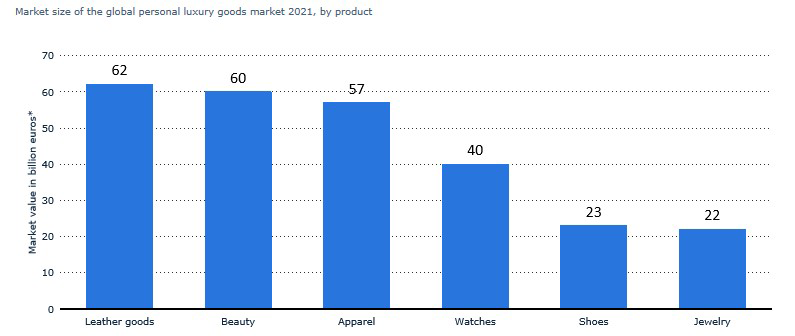

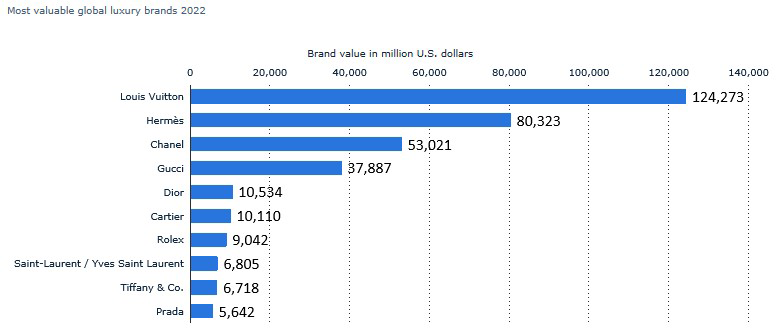

Reason 3: Follow the Big Brands

Buying watches from China comes with big perks. You’ve got a sea of different watch styles and wallet-friendly prices. Plus, China’s got this whole watch-making thing down with great factories and expert workers, making it a go-to place for brands that want good quality without the hefty price tag.

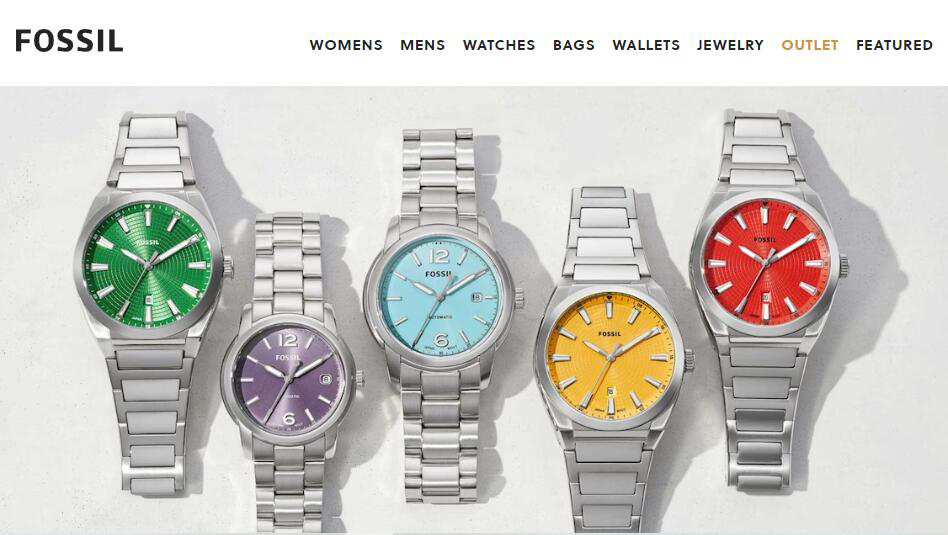

Many popular brands, such as MVMT, FOSSIL, etc., have been at the top of the market in terms of sales volume for many years, and they all source from the Chinese market.

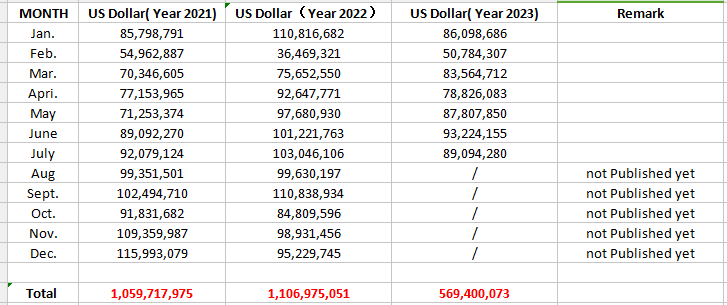

This is the export data for Quartz Watches from the year 2021-2023. the Data from China Customs

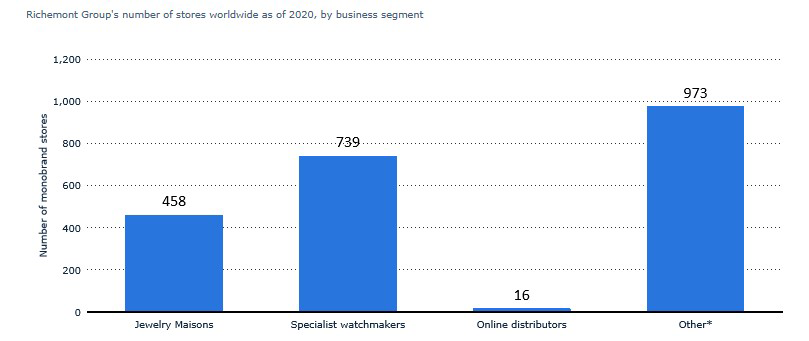

Where’s the Watches Manufactuing Supplier in China?

China’s watch production base, basically concentrated in Guangdong Province, Shenzhen, Guangdong Province occupies a large proportion, and in the western part of Shenzhen, mainly produces cheaper quality watches, in Dongguan Fenggang town, Guangdong Province, there is a large watch company-Dailywin Group(they OEM ODM watches for many big Swiss brands).

Guangdong is the go-to spot for watch parts like cases, dials, and straps. It’s got good prices, quick material supply, easy shipping, and a solid supply chain all set up. This makes Guangdong the top place for watch-making with a big advantage.

In Guangzhou, which is part of Guangdong, you can find lots of imitation watches. If you get the chance, you should definitely buy an imitation watch here. They’re made so well, you can hardly tell them apart from the real thing just by looking.

To learn about some of the replica watches in China, you can read this article

Replica and Original Watches, Differences? What are they? Where To Buy?

Many watches made in China are sold in the market, and many niche brands are looking for suppliers in the Chinese market, so the Chinese market is very well-informed about some of the market trends.

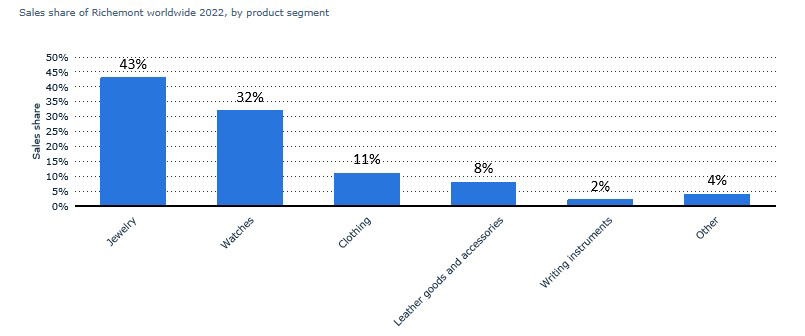

What Types of Watches & Methods for Sourcing Watches in China?

There are many types of watches, and you should first understand what style you’re looking for in order to find the right supplier. For reference on watch styles, you may want to check out our comprehensive article:

also If you are out of China, how do you search for a Chinese supplier? they can be B2B platform, socisl platform, and trade fairs.

Methods for Sourcing Watches in China?

On Social Platforms

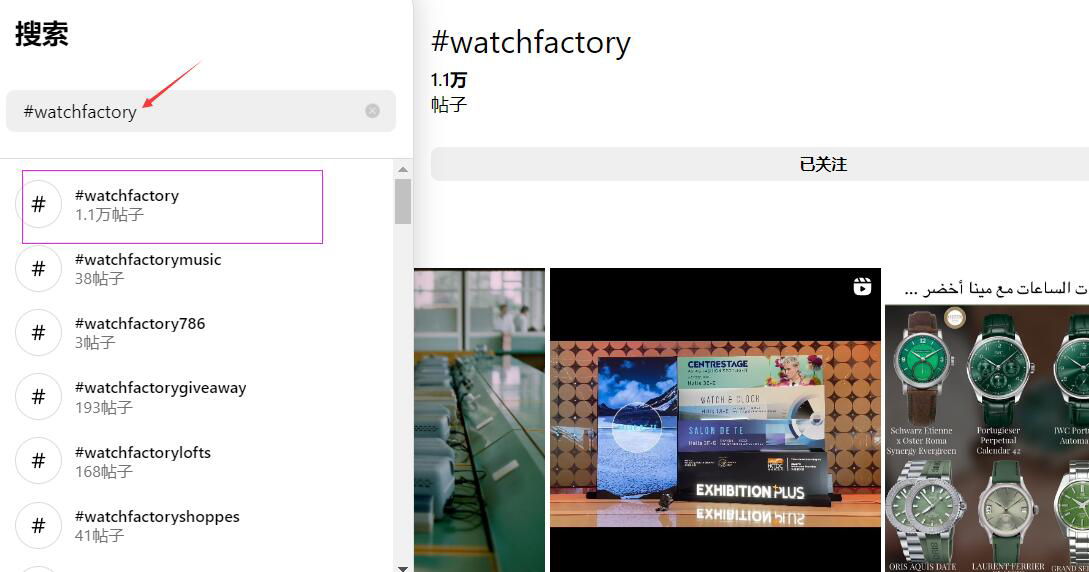

You can sourcing watches supplier from Wechat video moment, or normally used platform, like instagram, facebook, let’s check How to source from social platform?

Search keywords on the platform.

such as Instagram, Search #watchessupplier, #OEMwatchesmanufacturer, #watchfactory, and some other keyword search.

Then filter. the same way when using other social platform.

Social Platforms-Pros Vs Cons

- יתרונות: Rapid Familiarization with Suppliers: In the era of short video content, many watch suppliers showcase their products and company information on social platforms like WeChat and LinkedIn. This enables quick understanding of suppliers and their offerings.

- חסרונות: Variable Supplier Quality: Since many suppliers promote themselves on these platforms, the quality and reliability of suppliers can vary significantly. Careful discernment is needed.

To ensure a successful sourcing experience, brands need to employ effective strategies for identifying and vetting trustworthy watch suppliers on social platforms.

Multi-faceted Assessment: Before placing orders, thoroughly assess suppliers, including their company strength, sample quality, product packaging, service capabilities, and more.

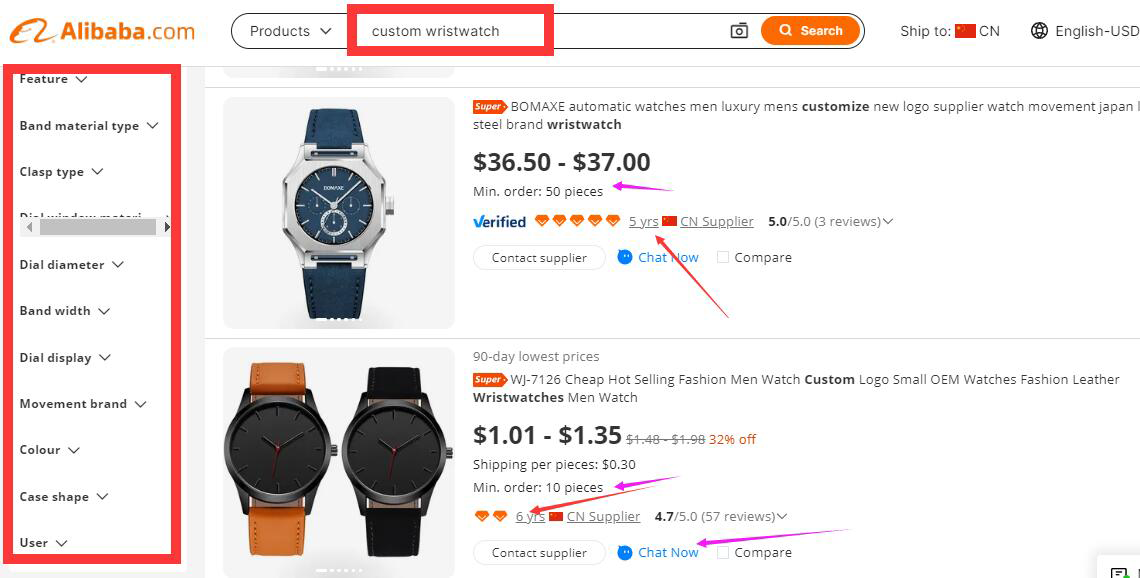

On B2B Platforms

Popular B2B platforms in China, including Alibaba, Made in China, and Global Sources, offer unrestricted access. You can create an account with just an email address or phone number.

After registering an account on the platform, you can search with the product keywords “שעונים” “wristwatches” ” timepiece” + OEM/customize/wholesale, etc..

such as search on Alibaba:

To navigate B2B platforms effectively, consider these techniques:

- Supplier Evaluation: Learn suppliers, their foundated years(production skills), their market(stands for their quality), their production time, and sample rule, including assessing their reputation, product quality, and responsiveness.

- Identifying Trustworthy Watch Suppliers and Verifying Credentials: after checking the basic information of the supplier, the fastest way to identify a supplier is to buy a sample or place a small order. for mass order, one way is to check existing quality sample.

On Trade Fairs

Attending watch fairs and exhibitions can be immensely beneficial for networking and finding potential suppliers. We explore the advantages of participating in such events.

Here’s a list of some well-known watch fairs in China:

- China Watch & יריד שעונים (CWCF)

- שעון שנזן & Clock Fair (the most famous Fair in China Watch fair)

- שעון הונג קונג & יריד השעונים (אם כי מבחינה טכנית בהונג קונג, הוא נמצא בסמיכות ליבשת סין ומהווה אירוע משמעותי עבור התעשייה)

- יריד השעונים של שנחאי

- יריד שעוני בייג'ין

- יריד שעוני גואנגג'ואו

Know more about watch fair from this post: https://ohlalawatch.com/what-are-the-exhibitions-forums-in-the-watch-industry%ef%bc%9f/

Proper preparation is essential to maximize the benefits of attending watch fairs. Building strong relationships with suppliers is key to long-term success.

Effective Way to Communicate with Watches Suppliers

Keep effective Communication with suppliers by choosing right tools, Chinese suppliers like to use WeChat, and WhatsApp to communicate, if there is important information, they will send and save it via email.

Regularly communicating with suppliers to ensure smooth operations

Key Considerations When Sourcing Watches in China

When sourcing watches in China, You should consider about their quality and products standars, prices and MOQs (Minimum Order Quantities)

Watches Quality and Standars

Understanding the technical aspects and quality standards of watches is crucial to ensure that the sourced products meet your brand’s expectations. mentioned quality assurance, mostly are 1 year, some supplier can be 2 years.

Requesting product samples and performing quality inspections are essential steps to assess the product’s quality before committing to a supplier.

Dealing with Proper MOQs

Minimum Order Quantities can significantly affect your inventory management and profitability. In the watch industry, because the products are not cheap and you need to open a mold to make any product, the number of products becomes a pain point in the industry.

Most OEM watch suppliers will require 300-500pcs MOQ for each style, Which makes it harder for sourcing buyers to make a decision.

Knowing why OEM Watches price are high and Why Oem watch suppliers are asking for such high quantities may help you in your purchasing plan.

Therefore, it is the best choice to match the colors and the literal design reasonably, and it is better to develop new products according to the situation of inventory.

We do with 300-500pcs moq with multi colors

Logistics & Import Regulations

From our experiences, the peak season for watches each month is March, April, May, September, October, November, and December, Every year around the Chinese New Year( December to March), logistics costs go up, and logistics will be crowded.

Choosing the appropriate shipping method is critical to ensure timely delivery and cost-efficiency.

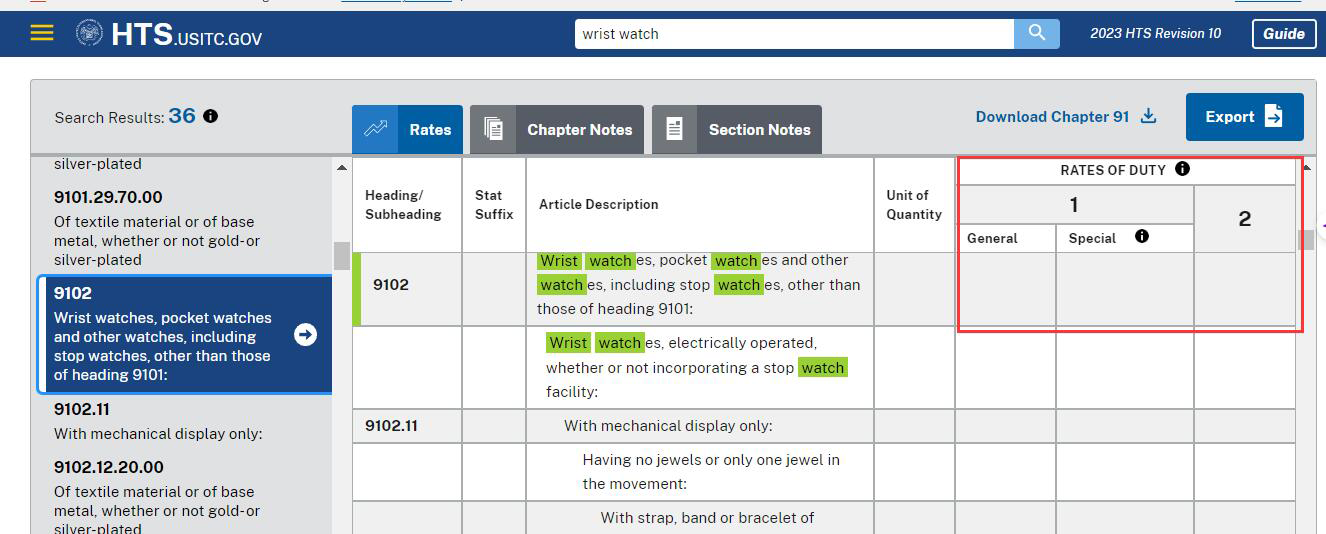

Familiarizing with import regulations and customs duties

Every commodity will have import tariffs, and there will be different tariffs depending on the product, no matter what logistics method you send, express or ocean freight, be sure to understand the import tariffs you need to pay, before importing to understand the import tariffs, whether or not there are incentives, whether or not you can afford these tariffs, the tariffs should also be added to the cost of the product inside.

Note: Before checking the Import Tarrif, You should use your country’s hs code, Check the HS code for your products first. Not China’s HS code. such as:

Navigating import regulations and understanding customs duties will help brands avoid potential delays and unforeseen expenses.

Avoiding Common Pitfalls in Sourcing Watches from China

While sourcing products from China, it’s possible to encounter fraudulent activities, just as you might anywhere else. It’s a common risk in global trade, so always proceed with caution.

How to Spot & Avoid Scams ?

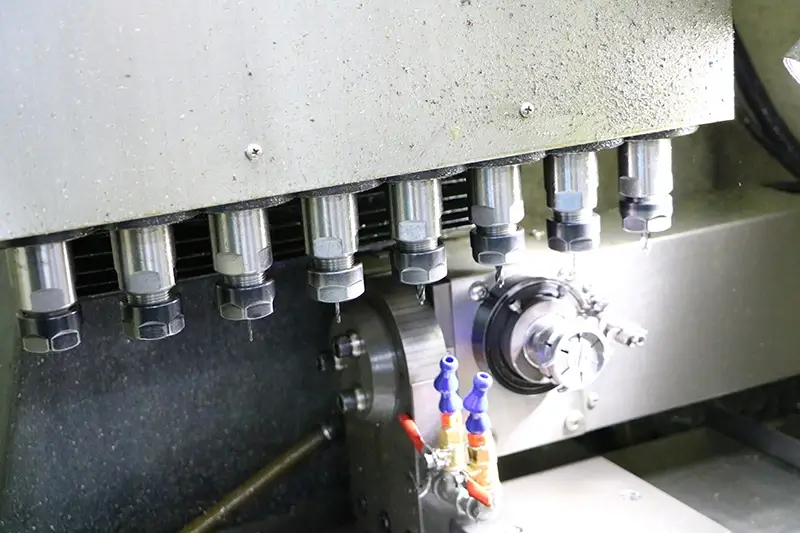

Conducting Factory Visits Before Placing Order

In-person visits to supplier factories offer valuable insights into their production capabilities and ethical practices.

Visiting a supplier’s factory allows you to get in touch with the owner of the factory to see the owner’s business philosophy, their attitude to facing problems, and their level of quality, so that when you meet a hard situation, you’ll be able to know if this supplier can handle it with you.

cnc millingVisiting factories, check their production environment, and employee status, but also to be able to understand your product more, for the growth of your brand is more favorable.

You can Sign NDA

If you have your own brand design, then be sure to sign a non-disclosure agreement(NDA) with your supplier to ensure that you have exclusive ownership of your product design.

Educating oneself on common scams and fraudulent practices can prevent brands from falling victim to unscrupulous suppliers.

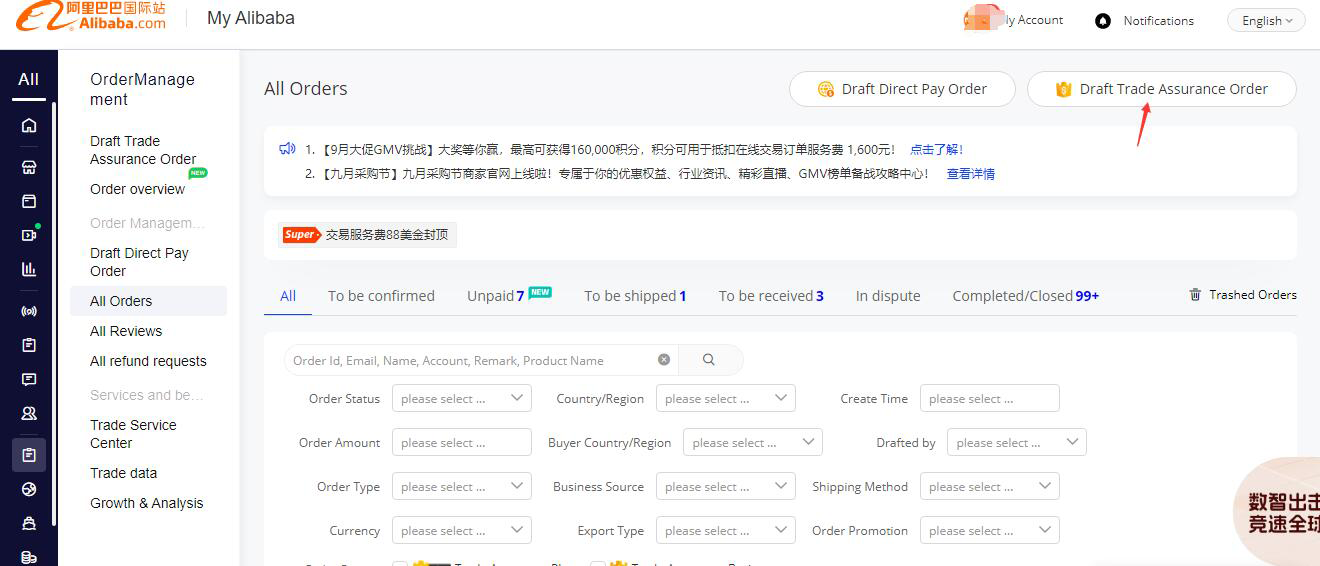

Using Escrow Services and Secure Payment Methods

- If you are shipping by sea, then make sure you have marine insurance.

- Before each payment, be sure to repeatedly confirm the bank account information with your watch supplier, it is best to confirm in a variety of ways, there are many many cases that many scammers will steal the supplier’s mail account and password to modify the supplier’s bank account, and then let you be fooled!

- Make sure that the payment account is a formal company, let the supplier put the payment method on the PI, or go online Alibaba, Alibaba has trade assurance orders, to protect your rights and money!

- Implementing secure payment methods, such as escrow services, provides an added layer of protection for financial transactions.

Trademarks

Protecting your brand’s intellectual property is essential to prevent counterfeiting and unauthorized use of your designs. We highlight the importance of registering trademarks and patents to secure legal protection for your brand and products

Importance of Trademarks in Watchmaking:

Trademarks are distinctive symbols, names, or slogans used to identify and differentiate products or services. In the wristwatch industry, trademarks serve several critical functions:

- Brand Recognition: Trademarks allow consumers to easily identify and connect with their favorite watch brands, fostering brand loyalty and trust.

- Quality Assurance: They signify a commitment to quality and craftsmanship, assuring consumers of the watch’s authenticity and reliability.

- Legal Protection: Trademarks provide legal grounds for watch brands to take action against counterfeiting and unauthorized use of their marks.

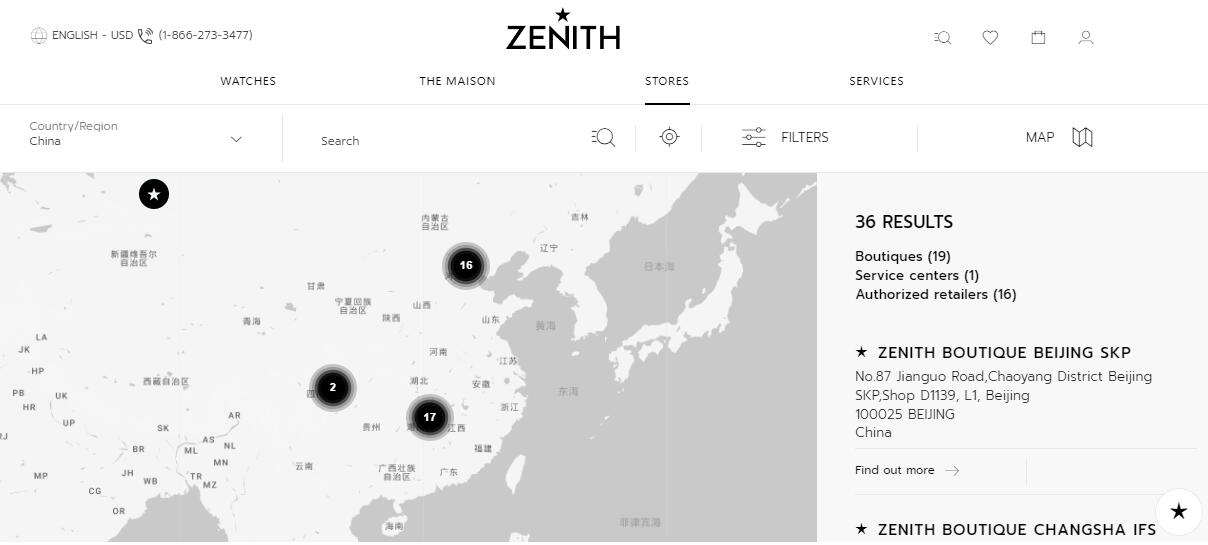

Examples of famous watch brand trademarksSeveral watch brands have iconic trademarks that have become synonymous with their identity. Here are a few notable examples:

- Rolex Crown: The Rolex crown logo is one of the most recognizable symbols in the watch industry, representing precision, luxury, and exclusivity.

- Omega’s Seamaster Logo: Omega’s trademarked Seamaster logo, with its wave design, is closely associated with the brand’s maritime heritage and innovation.

- TAG Heuer’s Shield: TAG Heuer’s shield emblem symbolizes performance, innovation, and avant-garde design.

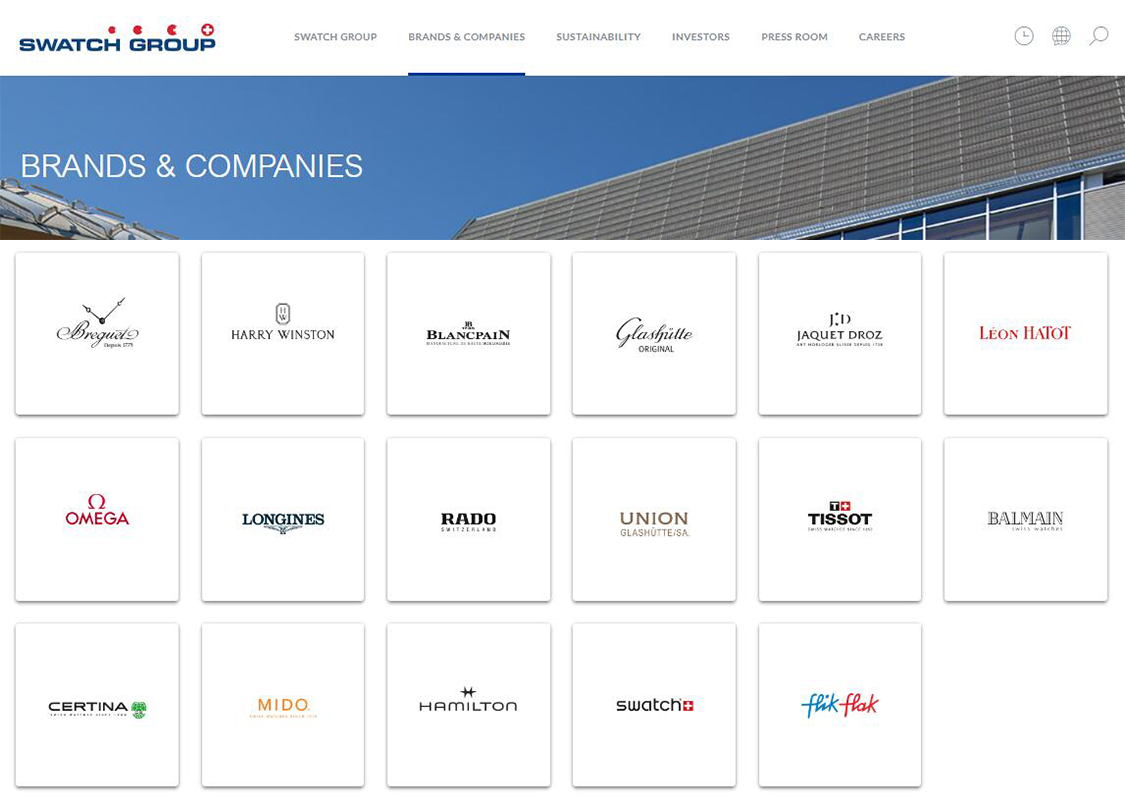

- Swatch Group Brands: The Swatch Group owns multiple brands, each with its distinct trademark. For example, the Swatch brand itself is known for its colorful designs, while Breguet features intricate guilloché patterns.

Common Trademark Infringement Scenarios in the Industry:

Despite the protective measures in place, the wristwatch industry faces various trademark infringement challenges:

- Counterfeiting: Counterfeit watches often bear copied or altered trademarks, deceiving consumers into believing they are purchasing genuine products.

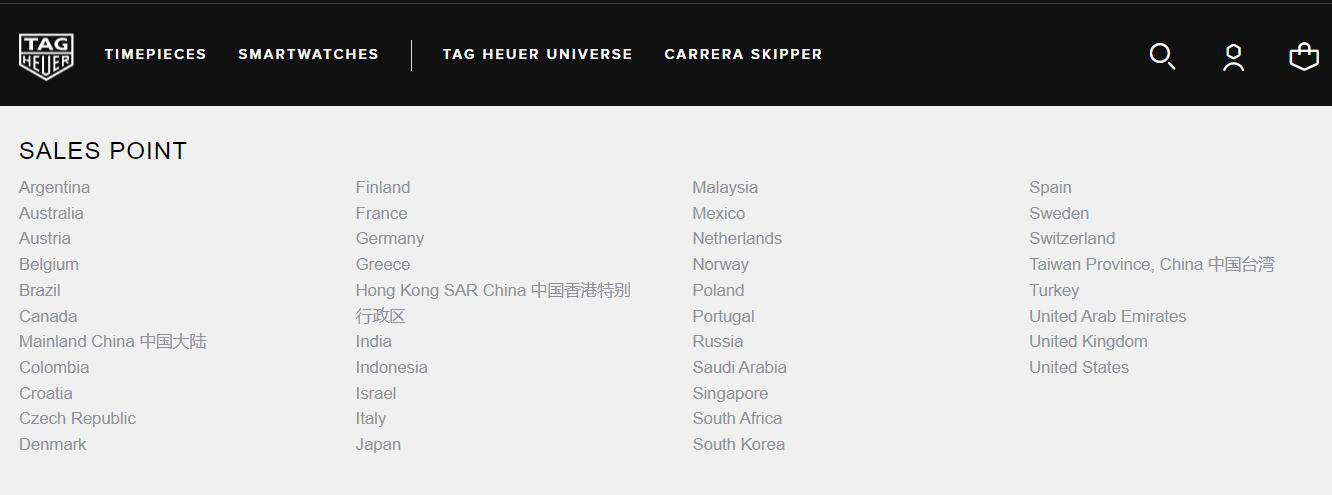

- Unauthorized Reselling: Some retailers may sell watches without proper authorization, infringing on the brand’s trademark rights.

- Parallel Imports: Parallel imports involve the sale of authentic watches in a region where the brand’s official distributor did not intend for them to be sold. This can raise trademark issues.

- Online Infringement: The internet has facilitated the sale of watches with counterfeit trademarks on various online platforms.

Protecting your brand’s trademark rights or not use other’s design is essential in preserving its reputation and market position. It involves not only obtaining trademark registrations but also actively monitoring the market for potential infringements and taking legal actions when necessary. In the next section, we will explore strategies for registering and enforcing trademarks to prevent and address intellectual property infringement issues effectively.

Conclusions

In summary, China’s rising prominence in the global watch market offers compelling opportunities for sourcing timepieces. Advantages include diverse styles and competitive pricing. Key considerations encompass understanding the Chinese watch landscape, effective supplier selection, quality assurance, and logistics management. Building strong supplier relationships, guarding against scams, and protecting intellectual property rights are crucial. Brands must actively monitor the market for trademark infringements.

By following these strategies, Whether it’s a name brand watch, a niche watch brand, or a starter watch brand, you will be able to find the right supplier and develop together with your supplier

Related Posts:

הוא פונה הן לצרכנים המודעים לאופנה והן לצרכנים בעלי אוריינטציה ספורטיבית, ומציע שילוב של נקודות מחיר וסגנונות.

הוא פונה הן לצרכנים המודעים לאופנה והן לצרכנים בעלי אוריינטציה ספורטיבית, ומציע שילוב של נקודות מחיר וסגנונות.